Helios has partnered with CashBack Bankcard Processing to offer unparalleled integration of Point of Sale, EFT and online payment processing applications.

With over 20 years of industry-leading innovation and experience into an intuitive yet powerful employee-facing interface, Helios seamlessly interchanges information collected at the point of sale into a real-time merchant processing solution that is faster, easier more reliable and more secure than traditional offline POS terminals. Additionally, in-house EFT data ensures complete accuracy and control managing EFT membership programs. No other software can offer the simplicity or efficiency of EFT processing that is available through Helios.

POS CC Swipe

When a client wants to pay for today’s purchases with a credit or debit card, Helios will present a window for the employee to swipe the card. The transaction will process with an immediate approval or decline.

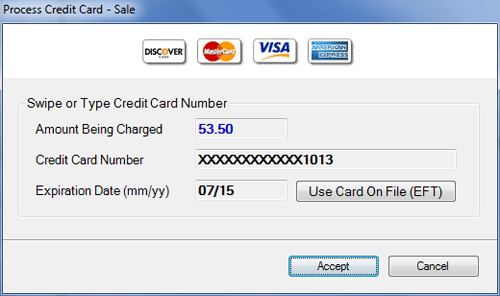

POS CC on File

When a client wants to pay for today’s purchases with a credit card that is on file, the Helios window provides a button to use the Card On File from the EFT Billing Profile if one is present and active.

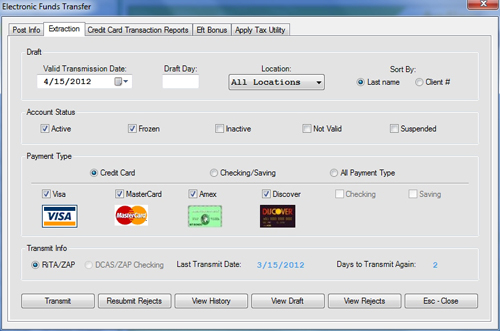

EFT Extraction

During the EFT draft process, the Extraction screen allows you to define which accounts should be included in the EFT batch. This can be based upon the status of the membership or even the form of payment.

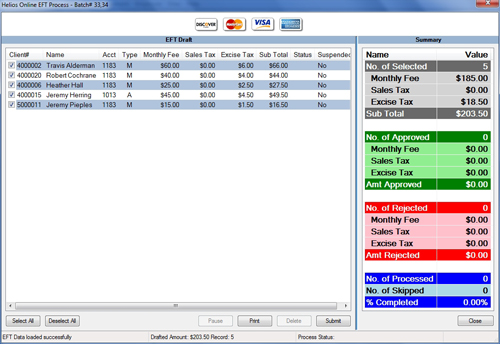

EFT Draft

During the EFT draft process, a list is provided for review prior to submitting the batch for processing. Any last-minute changes can be made and a summary provides a snapshot of the batch and estimated revenue.

Decline EFT sample

When a client’s EFT draft fails, the balance plus any applicable reject fee is recorded on their profile and can be flagged to prohibit service until the balance is paid or you can choose to provide a grace period number of days or visits before service is prohibited.

What is an EFT?

The benefits of EFT’s are many. While there is a small fee per transaction for this service, EFT’s eliminate the need to print, process and send a monthly bill in many instances.

Having the fee automatically deducted from your customer’s checking account increases the retention of those who might otherwise let the service lapse.

In addition EFT’s allows your salon to make money even during your slow season. This allows you to project cash flow and more effectively budget for growth.

While you are saving money, your customers benefit from EFT’s as well. Your customers will no longer have to worry about missing billing deadlines. Bills are paid even when your customers are away from home. No more writing checks, no more postage, no more service charges for checks and no more embarrassing second billing notices and late payments. EFT is free to your customers and your customers will appreciate this value added service.

How does the EFT transfer process work?

First you have your customers sign a form that authorizes you to deduct their payment on a certain date. Your customers provide you with a checking deposit slip (or credit/debit card number) to verify all account information. Then you create the initial database. According to the billing cycle, the amount of your customer’s bill is then automatically debited from their checking account (or credit/debit card) and deposited into your account.

How safe are EFT’s?

All EFT’s are governed by the Federal Reserve Banking System. Only pre-authorized transactions are allowed to be processed. This is strictly enforced by the Federal Reserve. Customers must authorize all EFT debits from their checking account in writing.

Integrated Partners

Cashback Bankcard Processing (formerly Zap Payments) is a nationwide credit and debit card payment processing company started by payment processing industry veterans with a combined 35 years of experience processing payments for thousands of merchants all across the country. Traditionally, the way the payment processing industry finds customers is like most any other business: lots of costly advertising in print, on television and radio, or on the internet, along with salespeople paid large commissions to find customers.

However, instead of paying commissions to salespeople, CashBack simply pays merchants a monthly income to refer other businesses to CashBack. In the “Share the Wealth” referral marketing program, merchants are not only paid income for the merchants they refer directly to the program, but also for the merchants that these merchants refer… and the ones those referrals refer – up to three tiers of referrals! The income is equal to 10% of the profit that CashBack Corporation usually makes for the processing services provided to each of the businesses that are referred within the referral program. CashBack has partnered with some great companies nationwide, large and small. Credit card processing is something that is needed no matter how large or small a business is due to the technological advances which have driven us towards a cashless society. Accepting credit cards has proven to increase business up to 400%, and with the “Share the Wealth” referral marketing program your business receives more attention than ever!

Cashback is now taking on new merchants!

In a time where the bottom line means everything to your business, join with CashBack and start cutting costs off your credit card processing fees immediately. CashBack has saved 95% of merchants money in their first month!

You can start earning referrals in the first month of processing credit cards. CashBack does not require you to sell credit card processing; simply refer the people you already know by simply providing CashBack with basic contact information of your referral. You will then earn the monthly residual income.

CashBack’s rates cannot be beat when you factor in earning an additional monthly income. CashBack Processing enables your company to accept credit cards for all types of businesses. Accept all major credit cards as well as checks with the CashBack system. CashBack can set your business up to accept credit cards seamlessly. Call a CashBack a bank card processing specialist today!

8001 Woodland Dr., Indianapolis, IN 46278 info@gohelios.com

Helios, LLC is a division of New Sunshine, LLC. Copyright © 2025. All Rights Reserved. indianapolis web design by: imavex